–News Direct–

Ivy League university endowments rebounded from their losses in FY2022, but their significant exposure to venture capital meant that every major endowment likely underperformed traditional 60/40 and 70/30 global equity/bond portfolios, according to projections from Markov Processes International, Inc. (MPI), a leading independent FinTech provider of software and services for analyzing investment performance and risk.

The projections come from MPIs Transparency Lab, which tracks the performance of opaque pensions and endowments.

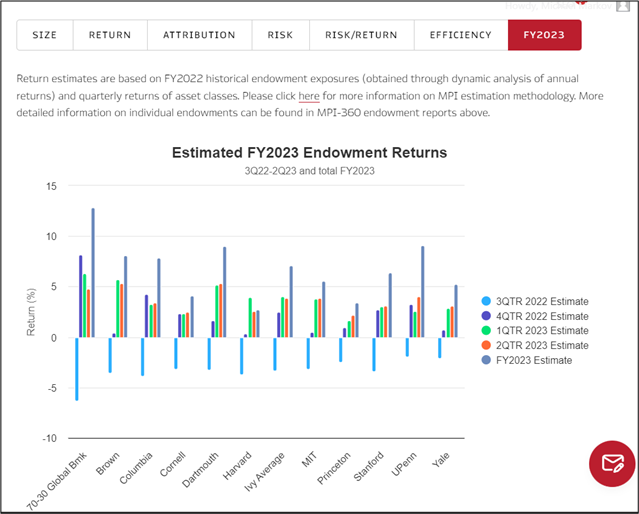

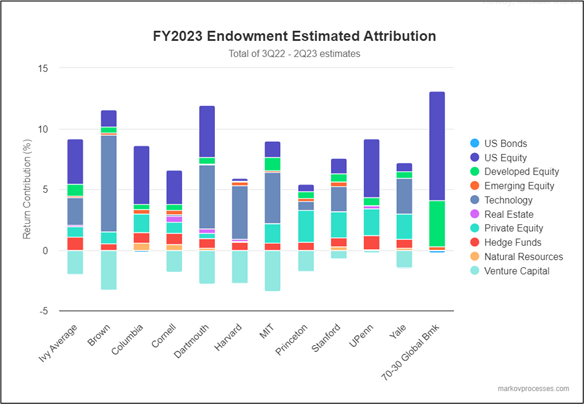

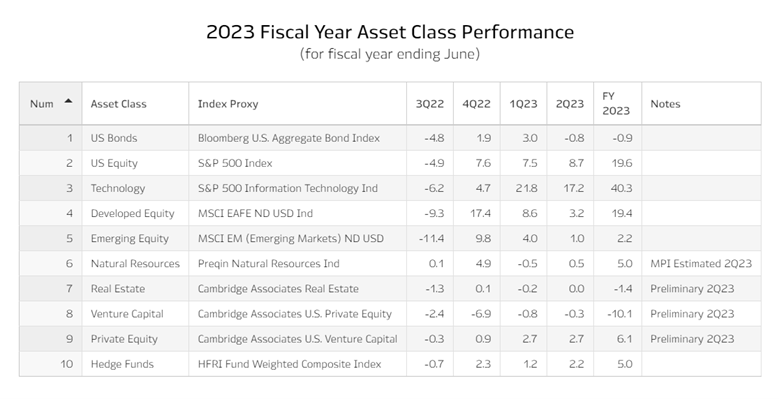

For fiscal year 2023, MPI projects that the Ivy League endowments tracked by the Transparency Lab had an average return of 7.13%, a reversal from the negative return of -2.39% for the group in fiscal year 2022. But that performance is expected to lag both traditional portfolios of global stocks and bonds: 9.36% for the 60-40, and 12.9% for the 70-30 over the same 12-month period ending June 2023. Endowments with the highest exposure to global equities (19.4% S&P 500 Index and 19.6% MSCI EAFE returns for the period) are expected to outperform, especially the ones that are known to make technology-focused investments both in public equity and alternatives, as the S&P 500 Information Technology index returned 40% for the period. However, endowments with significant venture capital (VC) investments are expected to lag, with a -10% return for the period based on second-quarter preliminary results from Cambridge Associates. VC is the only major asset class with significant negative impact on FY2023 results.

MPI Transparency Lab estimates that the University of Pennsylvania, Dartmouth University, Brown University and Columbia University endowments will have higher-than-average returns. Meanwhile, Harvard University and Princeton University are projected to be at the lower end of the Ivies.

Large university endowments are notoriously opaque, providing little indication of what results to expect until they officially release their results, making it a regular autumn spectacle, said Michael Markov, MPIs co-founder and CEO. But even then, after the annual returns are published, theres little indication of both sources of returns and the risks that were taken to achieve them. We apply our most advanced techniques to publicly sourced data to shed light on this important segment.

MPI utilizes proprietary technology and public data sources to peek, quantitatively, behind the curtain of a wide range of investments, providing information that is often impossible to obtain otherwise. With the Transparency Lab, all that data and analysis is contained in one place and publicly available, allowing investors, beneficiaries, regulators, researchers, journalists, and other stakeholders to garner unique insight into some of the largest and most opaque investors.

With the MPI Transparency Lab, registered users can view analytics and download MPI-360 reports that help them uncover trends in asset exposures, explain drivers of both recent and historical results, obtain estimates of risks, drawdowns and efficiency, perform historical stress tests, and evaluate various hypothetical scenarios.

MPI uses its proprietary Dynamic Style Analysis (DSA) and public annual returns to reverse-engineer asset exposure dynamics of large investor portfolios. When endowments report only annual performance figures, a decades worth of performance is represented by only 10 data points. Traditional static and rolling-window methods of regression analysis struggle to find credible insights from such infrequent data. MPIs DSA, however, is uniquely adapted to work with such limited data.

For additional information on MPIs proprietary data, visit the Transparency Lab. For further information, contact MPI at +1 (908) 608-1558 or info@markovprocesses.com.

About MPI

Markov Processes International Inc. (MPI) is a leading provider of solutions for investment research, analysis and reporting to the global wealth and investment management industry. MPI works with more than 200 client organizations, including pensions and endowments, sovereign wealth funds, global wealth management firms, institutional consultants, regulators, investment advisors and asset managers. Rooted in the principles of transparency, objectivity, and efficiency, MPI takes an innovative approach to problem solving in the areas of fund analysis, risk management, asset allocation, and reporting to ensure that its clients have the tools to succeed in ever-more-crowded markets. Follow us on Twitter @MarkovMPI and connect with us on LinkedIn.

Contact Details

For MPI

Company Website

https://www.markovprocesses.com/

View source version on newsdirect.com: https://newsdirect.com/news/venture-capital-and-technology-focused-equity-investments-will-define-2023-fiscal-year-ivy-league-endowment-results-according-to-mpi-760017317

Markov Processes Inc.

COMTEX_441375530/2655/2023-10-03T13:29:57

Julian Lopez is professor emeritus of finance, served as the founding academic affairs dean and founding chair of the finance department.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No journalist was involved in the writing and production of this article.