–News Direct–

Many traders are searching for the holy grail for picking winning stocks to tradethat magical indicator or that perfect candlestick pattern. Most are still searching after years of trying to learn to trade and actually make real money in the stock market.

There is now a NEW approach to using and analyzing stocks that makes trading easier, giving higher profits and less risk with more control over every aspect of your trades.

Relational Technical Analysis takes the guesswork out of choosing stocks to trade. This unique way of interpreting stock charts provides traders with the ability to get into a stock BEFORE the price runs in either direction.

One key element of the modern market that is seldom mentioned is the fact that the professional side trades on the millisecond. A millisecond means 60,000 trades can fire off before your order completes. Retail brokers are only required to fill orders within 1 minute.

If it seems as if your orders fill in seconds, this is to ensure that your order is lit before it is filled. All the computers monitoring the market can see your order. In fact, your brokers computer watches you type in your order and has the ability to keep track of your typical lot size and your typical entries.

Most traders make the common mistake of using retail news, retail commentaries as the market opens, and live trading events to make trading decisions.

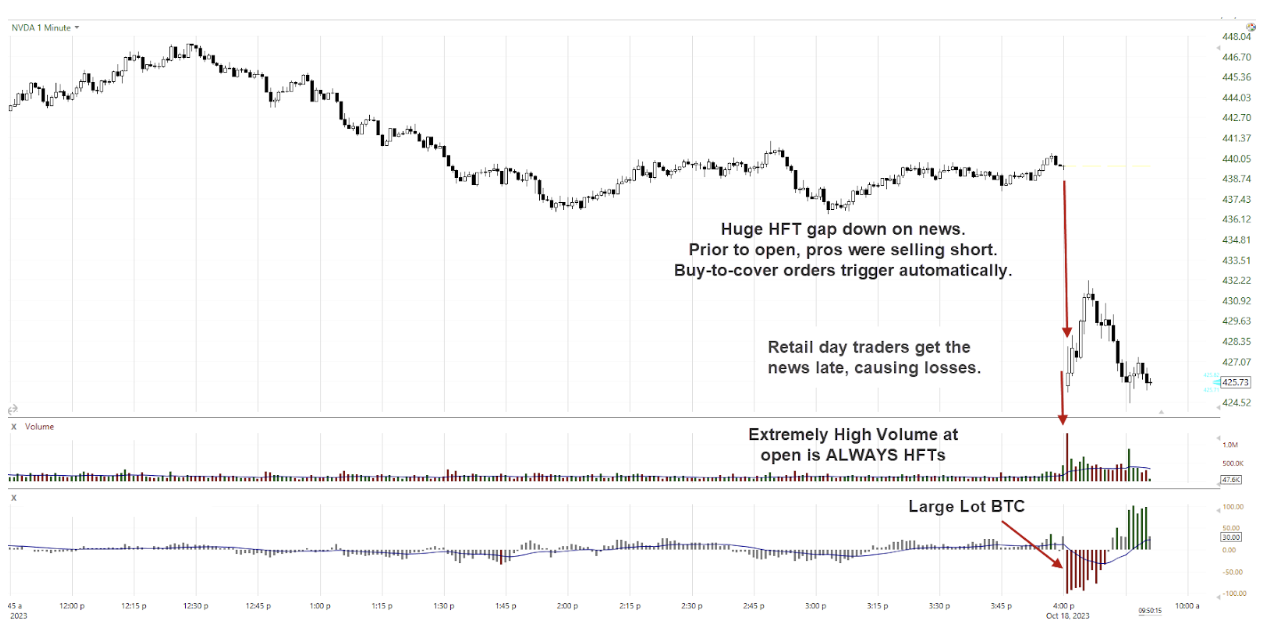

IF you use retail news to select a stock to trade on any given day, by the time you can read or hear the news, open your broker account, select the order type, select the lot size, and place your order, thousands of HFT and other professional-side orders have already triggered way ahead of your order.

When professionals and HFTs trade a stock, their orders are typically filled within seconds of the market open. They can determine when to start selling into the retail-side buying, so most retail orders end up with a whipsaw action that causes a small loss that grows larger as the trader waits, hopes and prays the stock will start running in the direction they hoped it would. Hope doesnt float in the market. Hope sinks and losses mount up. Trading losses increase and frustration erodes confidence.

Relational Technical Analysis uses the new Leading Hybrid Indicators that actually signal BEFORE price moves. A black candle can be the last candlestick on the chart but the Leading Hybrid Indicator signals that the price is going to change and move up. This means you are buying with the professional traders who trade large lots that are not always on the exchanges.

Relational Technical Analysis allows retail traders to trade with the professionals, and similarly to a professional. It takes the guessing, confusion and frustration out of selecting stocks to trade and determining entry price, order type, stop loss, trailing profit stop, liquidity constraints and the speed of execution risk factors.

Professionals enjoy their job. They take pride in being able to strike the penny spread they have determined. Their routing is fully automated to send their orders at a speed that is beyond the retail sides access. Professionals use several different kinds of mitigation tools, risk assessment tools and lot sizes that are 10 times or more the size of the average retail trader.

They also make profits 90% of the time. That is the norm for professional traders. With these facts, you can begin to understand that you need to join the professionals when, where and how they trade, rather than constantly going up against them blindfolded.

Professionals are highly trained, extremely skilled traders who generate most of the momentum in stocks by using several types of controlled bracketed orders, special routing, and the know-how to nudge the HFTs, which are the fully automated Maker/Takers of the market.

High Frequency Trading Firms have been around for over 20 years and are approved by the SEC to provide the exchanges with market-open liquidity, which the exchanges pay them to provide.

HFT orders fill the queues of the market before the market opens. This creates huge liquidity leveraging either to the upside or downside before the market open. The automated Market Making Computers identify which side of the order the huge anomaly of orders reside. If HFTs intend to gap up a stock, the huge number of small lot orders require that the Market Making Computers gap the stock up to a price level where seller orders are at that time.

In the chart below, the sell orders forced a gap down at open. Pros were already positioned to take profit with Buy to Cover (BTC) orders at open.

When the market opens, the HFTs cancel most of the orders and use the remaining orders to sell into the retail news traders buy orders. Thus, retail traders get their orders filled at the market open or within a few minutes. These order executions give HFTs and other professionals huge profits and retail traders huge losses.

By learning Relational Technical Analysis, one can learn to pick trades at the right time, to trade with the Professional Traders and avoid the often huge losses caused by following news and HFT activity.

Martha Stokes, CMT

https://www.technitrader.courses

TechniTrader has been teaching traders and investors a complete process for trading or investing in the stock market and other financial markets since 1998. We have helped over 500,000 traders and investors achieve their financial goals. Our courses provide a complete, comprehensive training program based on a college-style curriculum that uses a tri-level approach to analyzing assets or derivatives to trade.

This post contains sponsored content. This content is for informational purposes only and not intended to be investing advice.

Contact Details

Mel Ainuu

Company Website

https://www.technitrader.courses/

View source version on newsdirect.com: https://newsdirect.com/news/trading-smarter-with-relational-technical-analysis-890334262

TechniTrader

COMTEX_442483214/2655/2023-10-26T09:24:48

Julian Lopez is professor emeritus of finance, served as the founding academic affairs dean and founding chair of the finance department.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No journalist was involved in the writing and production of this article.