–News Direct–

If inflation isnt making you sick, it might be keeping you sick.

Debt.coms 2023 medical debt survey shows some worrisome increases over its 2022 results:

- This year, 67% reported that inflation made it harder to pay medical bills. Thats a significant jump from 57% the year before.

- Nearly a third (32%) said their medical bills were in collections this year. Last year, it was only 28%.

- Most concerning of all: 34% admitted they have been avoiding medical care because of debt up from 28% in 2022.

Inflation may be subsiding, but the damage it wrought will stay with us for a long time, says Debt.com founder and chairperson Howard Dvorkin, CPA. Medical debt was a growing problem before inflation, even before the pandemic. Now its becoming a crisis.

CPA and chairman of Debt.com

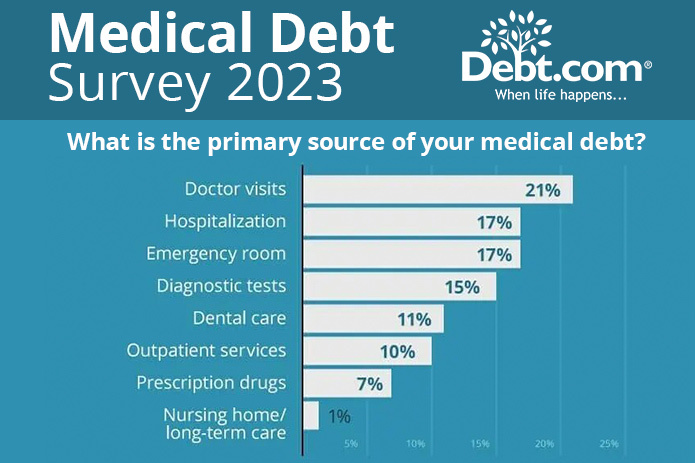

The problem is so pervasive, its no longer a major illness that causes financial problems. Its regular appointments with doctors even more than going to the hospital or emergency room:

2023 primary source of medical debt

- Doctors visit: 21%

- Hospitalization: 17%

2020 primary source of medical debt

- Doctors visit: 15%

- Hospitalization: 25%

The only good news in this years Debt.com survey is that the amount of medical debt is lower than in past years:

2023 medical debt amount

- Less than $500: 56%

- $1,000 to $5,000: 15%

2020 medical debt amount

- Less than $500: 20%

- $1,000 to $5,000: 34%

Dvorkin believes these results show Americans are so financially stressed, they can no longer afford even the basic medical care. Medical debt doesnt exist in a vacuum. Its quite likely that doctors visits have become harder to pay because Americans have many other debts theyre juggling. Credit card balances are approaching levels not seen in decades, and student loans arent getting any smaller. Add in regular checkups, and its a cumulative and pervasive problem.

Even worse, Dvorkin says these numbers reveal that Americans are unaware of the proven methods to help with medical debt from payment plans to debt settlement. Today, most people are aware of their credit scores, and they understand the impact of high interest rates on their credit cards. Theyre even learning about their options for lowering student loan payments. But they dont know how to handle their medical bills. And thats just not good for their health.

CPA and chairman of Debt.com

How Does Medical Debt Impact Americans' Finances?

About Debt.com: Debt.com is a consumer website where people can find help with credit card debt, student loan debt, tax debt, credit repair, bankruptcy, and more. Debt.com works with vetted and certified providers that give the best advice and solutions for consumers 'when life happens.' For Spanish-language website: Debt.com/es

Contact Details

Debt.com

William Wolf

Company Website

View source version on newsdirect.com: https://newsdirect.com/news/survey-reveals-how-inflation-is-impacting-americans-physically-and-financially-932480290

Debt.com

COMTEX_442195525/2655/2023-10-20T17:49:12

Julian Lopez is professor emeritus of finance, served as the founding academic affairs dean and founding chair of the finance department.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No journalist was involved in the writing and production of this article.